World

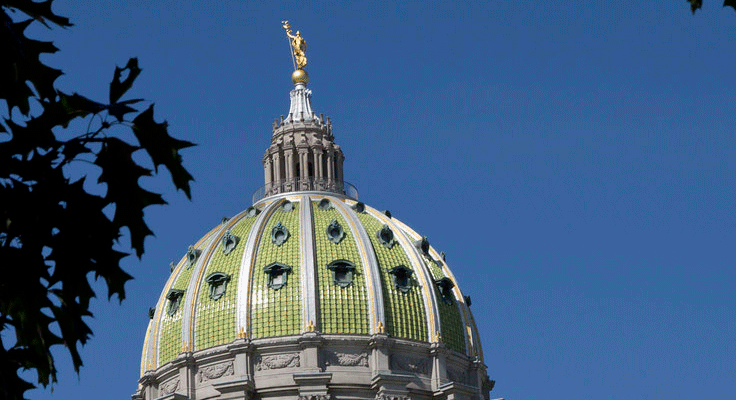

Shusterman Proposes Bill to Restructure Pennsylvania Tax Funding

State Representative Melissa Shusterman, a Democrat from Chester County, has unveiled plans to introduce a bill aimed at restructuring the way Pennsylvania collects and allocates its tax revenues. This proposed legislation seeks to create a more equitable system by dividing the state into three distinct economic categories, allowing each region to retain the tax dollars it generates. These funds would be directed towards essential services such as schools, public safety, health care facilities, parks, and roads.

Shusterman highlighted the inadequacies of the current tax funding system, stating that it fails to provide sufficient financial stability for local communities. “We need a different approach to address the constant funding disparities in our communities and help residents see the direct impacts of their hard-earned tax dollars,” she emphasized. This initiative, according to Shusterman, aims to respond to long-standing concerns expressed by lawmakers who have historically resisted allocating additional state resources to the Southeastern Pennsylvania region.

Proposed Changes and Regional Accountability

The proposed restructuring would empower regions to self-fund their essential services. By retaining the tax revenue generated locally, Shusterman believes communities will have clearer accountability over how their tax dollars are utilized. “This approach will honor those goals while ensuring that residents can directly see the benefits of their contributions,” she added.

The introduction of this legislation is expected in the coming weeks, signaling a potential shift in Pennsylvania’s approach to tax funding. If passed, this bill could reshape the financial landscape for many communities across the state, particularly in areas that have previously felt disadvantaged by the existing system.

For residents of Chester County and surrounding areas, the implications of this proposed bill could be significant. By promoting a method that allows localities to manage their own tax revenues, Shusterman aims to create a more balanced distribution of resources that reflects the economic realities of different regions.

As the bill prepares to be introduced, stakeholders and community members are encouraged to engage in discussions about its potential impact. The outcome of this initiative could set a precedent for how tax revenues are managed in Pennsylvania, and possibly influence similar efforts in other states.

For ongoing updates on this legislation and other developments in Chester County, residents can follow local news sources for the latest information.

-

Lifestyle3 months ago

Lifestyle3 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports3 months ago

Sports3 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports3 months ago

Sports3 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle3 months ago

Lifestyle3 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle3 months ago

Lifestyle3 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World3 months ago

World3 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science3 months ago

Science3 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Science2 months ago

Science2 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Business3 months ago

Business3 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science3 months ago

Science3 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports3 months ago

Sports3 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science3 months ago

Science3 months agoNew Study Confirms Humans Transported Stonehenge Bluestones