Top Stories

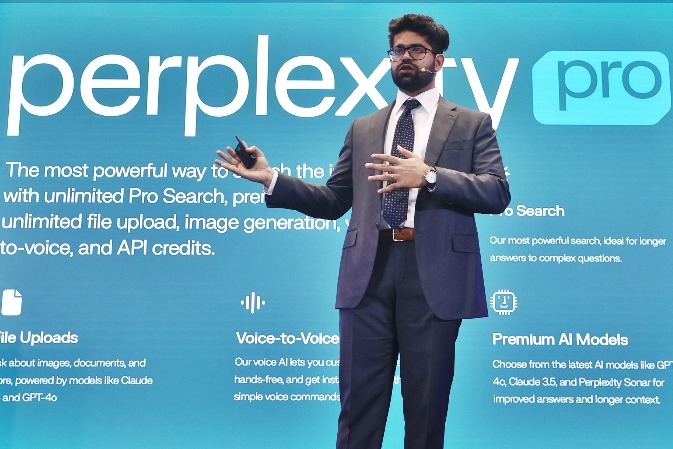

Mirae Asset Invests $110 Million in Perplexity AI, Valuing Firm at $20 Billion

Mirae Asset Global Investments Co. has made a substantial investment of approximately 150 billion won (equivalent to $110 million) in Perplexity AI Inc., a developer of AI-driven search engine technology. This investment positions the company at a valuation of $20 billion. The news was confirmed by sources familiar with the transaction on Thursday.

Based in San Francisco, Perplexity AI has emerged as a significant competitor to established tech giants, notably Google Inc.. The investment from Mirae Asset was facilitated through its US division, adding to a roster of notable shareholders that includes Samsung Electronics Co. and SK Telecom Co.. The exact amount raised in this latest funding round has not been disclosed, but it reflects a substantial increase from the $18 billion valuation estimated during its previous fundraising in July.

Founded in 2022, Perplexity AI integrates real-time web search capabilities with large language models (LLMs), enabling it to provide detailed responses to user inquiries. The company has attracted significant investment in recent months, including an undisclosed amount from Samsung’s US investment arm, Samsung Next, and a commitment of $10 million from SK Telecom.

Growing Investments in AI Technology

The global interest in AI technology is evident from the substantial funding that Perplexity AI has secured. Following a successful $25.6 million Series A funding round in 2023, the company raised $73.6 million from various venture capital firms, including Institutional Venture Partners (IVP), in early 2024, which valued the firm at $500 million. Notable investors also include Nvidia Corp. and Jeff Bezos, the founder and former CEO of Amazon, indicating strong confidence in the startup’s potential.

As part of its growth strategy, SK Telecom has partnered with Perplexity AI to integrate its search engine into the AI assistant platform A Dot, demonstrating the increasing collaboration between tech companies in the AI space.

Mirae Asset is recognized as a leading investor in AI sectors among South Korean financial firms. Its recent investments extend beyond Perplexity AI, including stakes in Rebellions Inc., a designer of AI chips, and Upstage, a developer of LLM-based AI models. Additionally, the firm has invested in AI advertising companies such as Moloco Inc. through its venture investments.

Future Endeavors and Strategy

The push into AI aligns with Mirae Asset’s strategic vision. Founder and Chairman Park Hyeon-joo has emphasized the group’s ambition to create a comprehensive AI platform that can deliver various investment products at significantly reduced fees. The ongoing developments in AI technology and partnerships highlight the sector’s potential for growth and innovation.

Perplexity AI’s trajectory mirrors the broader trends in the tech industry, where the demand for advanced AI solutions continues to rise. With strong backing from significant investors and strategic partnerships, Perplexity is well-positioned to further establish itself in the competitive landscape of AI-driven technologies. As the company expands its capabilities and offerings, the industry will be watching closely to see how it evolves in the coming years.

-

Lifestyle4 months ago

Lifestyle4 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports4 months ago

Sports4 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports4 months ago

Sports4 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle4 months ago

Lifestyle4 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle4 months ago

Lifestyle4 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World4 months ago

World4 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science3 months ago

Science3 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Science4 months ago

Science4 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Business4 months ago

Business4 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science4 months ago

Science4 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports4 months ago

Sports4 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science4 months ago

Science4 months agoNew Study Confirms Humans Transported Stonehenge Bluestones