Politics

New York Lawmakers Urge IRS to Investigate Nonprofit Groups

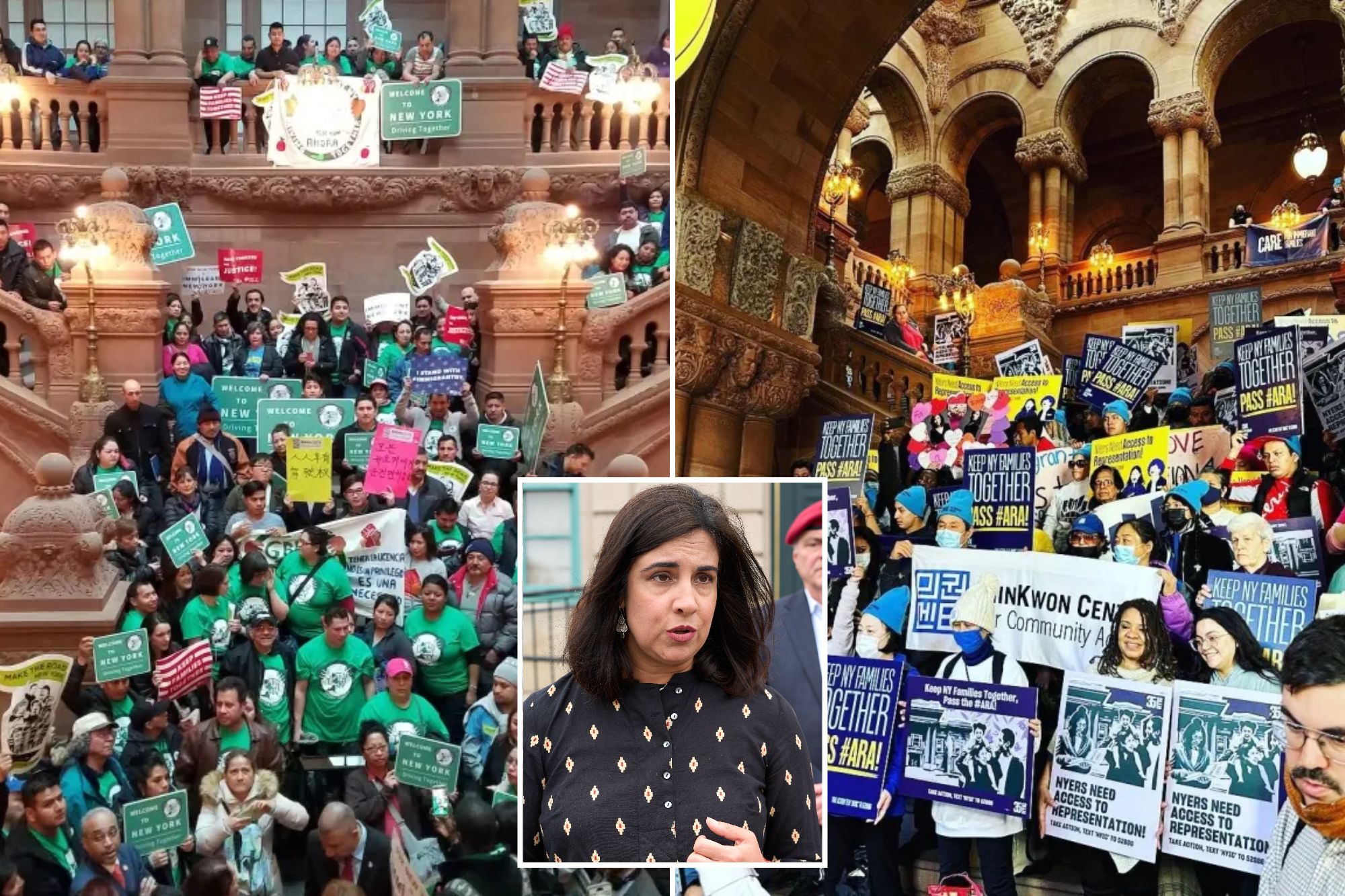

Two Republican lawmakers from New York have called on the Internal Revenue Service (IRS) to investigate four nonprofit organizations that they claim are using taxpayer funds to defy federal immigration laws. Representatives Nicole Malliotakis (R-Staten Island) and Claudia Tenney (R-Watertown) raised concerns about the nonprofit status of these groups in a letter addressed to IRS Commissioner William Hollis Long after an investigation by The New York Post revealed that these organizations received over $600 million in public funding while promoting sanctuary policies in New York.

The four organizations in question are the Bronx Defenders, NY Immigration Coalition, Make the Road NY, and NY Lawyers for the Public Interest. The lawmakers argue that these groups may be violating IRS regulations by providing services that encourage undocumented immigrants to evade federal immigration enforcement. In their letter, Malliotakis and Tenney expressed their concerns that these organizations could be using tax-exempt resources to support activities that “encourage, induce, or aid and abet an alien in unlawfully entering, remaining in, or evading detection within the United States.”

The Bronx Defenders alone has secured more than $500 million in city and state contracts since the fiscal year 2018, as detailed in the Post’s report. Other funding includes $56 million for Make the Road NY, $46 million for the NY Immigration Coalition, and $19 million for NY Lawyers for the Public Interest. These organizations have actively lobbied for the New York for All Act, a proposed law that would prevent state and local law enforcement from cooperating with U.S. Immigration and Customs Enforcement (ICE).

In their communication to the IRS, the lawmakers emphasized that IRS rules for tax-exempt organizations are intended for charitable, religious, or educational purposes. They contended that the activities of these groups do not align with these guidelines. “Combined with federal tax-exempt benefits, these public subsidies shift the financial burden onto taxpayers who may oppose the recipients’ efforts to shield removable aliens from enforcement,” they stated.

Malliotakis and Tenney also referenced an executive order issued by former President Donald Trump on April 28, 2025, which directs federal agencies to withhold funds from sanctuary jurisdictions, including New York City, that do not cooperate with federal immigration authorities. The lawmakers requested that the IRS investigate whether the actions of the pro-sanctuary groups obstruct federal immigration enforcement or involve unlawful advocacy.

If the IRS determines that these organizations have indeed violated tax-exempt status rules, the lawmakers have requested that appropriate actions be taken to revoke their tax-exempt status. The IRS has not provided any comments on the matter, citing privacy laws related to tax-exempt organizations. Representatives from the implicated groups did not respond to inquiries for comment.

This ongoing situation highlights the contentious debate over immigration policy and the role of nonprofit organizations in advocating for the rights of migrants in the United States. As the IRS reviews the allegations, the implications for these organizations and their funding could be significant, potentially reshaping the landscape of immigrant advocacy in New York and beyond.

-

Lifestyle3 months ago

Lifestyle3 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports3 months ago

Sports3 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports3 months ago

Sports3 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle3 months ago

Lifestyle3 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle3 months ago

Lifestyle3 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World3 months ago

World3 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science3 months ago

Science3 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Science2 months ago

Science2 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Business3 months ago

Business3 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science3 months ago

Science3 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports3 months ago

Sports3 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science3 months ago

Science3 months agoNew Study Confirms Humans Transported Stonehenge Bluestones