World

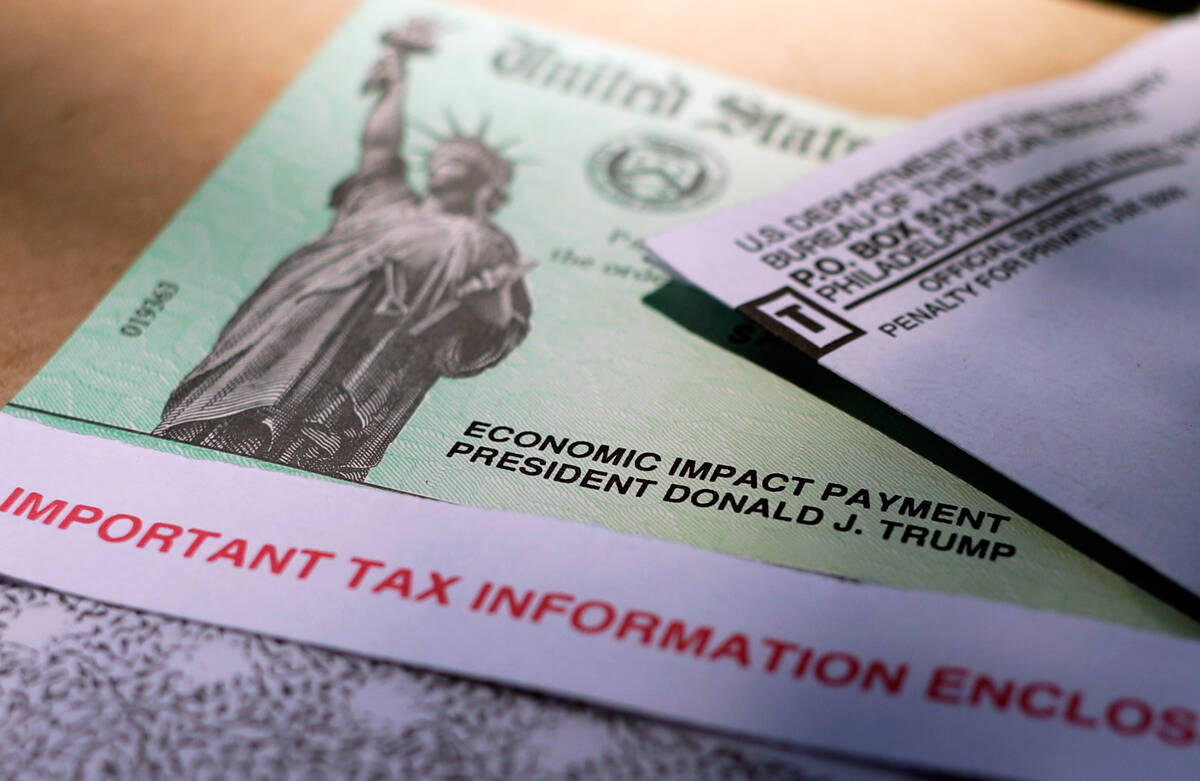

U.S. Government Confirms No New Stimulus Checks This Summer

Rumors circulated online recently suggesting that the U.S. government would distribute new stimulus checks to taxpayers in specific income brackets this summer. However, the Internal Revenue Service (IRS) has confirmed that no such payments will be issued in the near future.

A spokesperson for the IRS stated unequivocally that taxpayers should not expect any new stimulus checks. These payments, known as economic impact payments, require congressional approval through legislation, which has not occurred. The last significant distribution of stimulus checks, related to the COVID-19 pandemic, was facilitated by multiple pieces of legislation, including the American Rescue Plan Act and the COVID-related Tax Relief Act.

While speculation about a new round of payments gained traction, particularly regarding an alleged $1,390 check for low- and middle-income earners, these claims have been officially debunked. According to the IRS, no new credits are available for taxpayers to claim this summer.

Senator Josh Hawley of Missouri recently introduced a bill, the American Worker Rebate Act, which aims to provide tax rebates funded by revenue generated from tariffs instituted during the presidency of Donald Trump. This proposed legislation would offer a minimum rebate of $600 per individual, with additional payments for qualifying children. However, this bill has yet to pass through either chamber of Congress.

Taxpayers with an adjusted annual gross income exceeding $75,000 (for individual filers) would see a reduction in their rebate amount. Senator Hawley emphasized that Americans “deserve a tax rebate,” arguing that his legislation would allow hard-working citizens to benefit from the revenue generated by tariffs.

The IRS had earlier announced plans to distribute approximately $2.4 billion to individuals who had not claimed their Recovery Rebate Credit on 2021 tax returns. This credit was designed for those who missed out on prior COVID-19 stimulus checks, with eligible individuals able to receive up to $1,400. To claim this credit, taxpayers needed to file their 2021 tax returns by April 15, 2023.

Historically, stimulus checks have been authorized through legislation passed by Congress. For example, during the Great Recession of 2008, the Economic Stimulus Act facilitated similar payments. The Treasury Department, which oversees the IRS, has played a crucial role in distributing these payments during both the pandemic and the previous economic downturn.

Despite the current lack of new stimulus checks, the discussion surrounding tax rebates continues, particularly as lawmakers explore various funding mechanisms. As it stands, taxpayers should remain aware that no new direct payments will be made this summer, and any future rebates will depend on legislative developments in Congress.

-

Lifestyle3 months ago

Lifestyle3 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports3 months ago

Sports3 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports3 months ago

Sports3 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle3 months ago

Lifestyle3 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle3 months ago

Lifestyle3 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World3 months ago

World3 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science3 months ago

Science3 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Science2 months ago

Science2 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Business3 months ago

Business3 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science3 months ago

Science3 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports3 months ago

Sports3 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science3 months ago

Science3 months agoNew Study Confirms Humans Transported Stonehenge Bluestones