Health

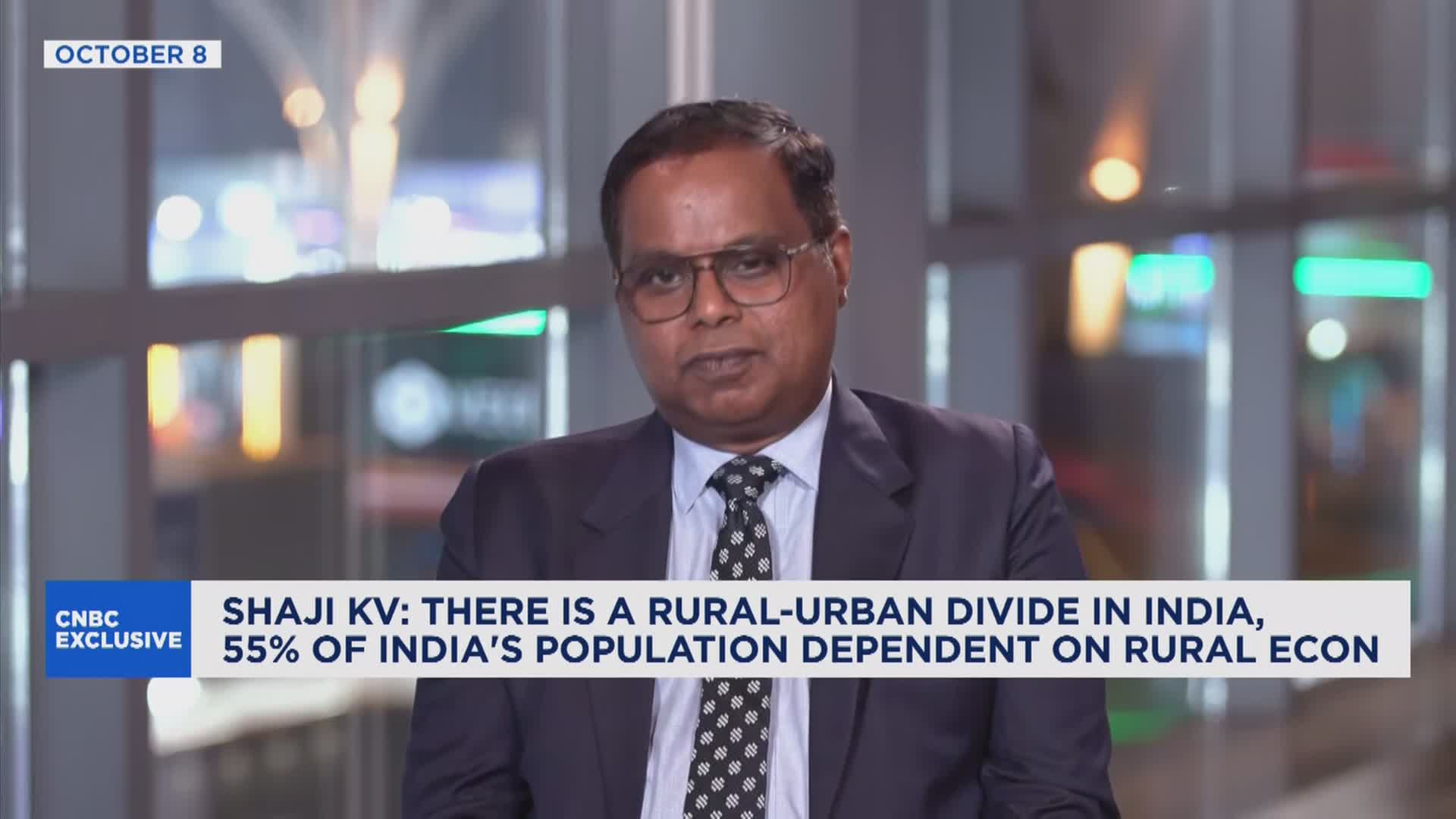

NABARD Chairman Calls for Financial Boost to Rural India’s Capital

The Chairman of the National Bank for Agriculture and Rural Development (NABARD), K.K. Vohra, has emphasized the urgent need to enhance the financial capital of India’s rural population. Speaking at a recent conference, he highlighted that improving access to finance is critical for the growth and sustainability of rural economies.

Vohra pointed out that a significant portion of India’s population relies on agriculture and related activities, yet many face barriers in accessing necessary funds. He argued that without a robust financial framework, rural communities struggle to invest in crucial resources, hindering their potential for economic growth.

Enhancing Financial Access for Rural Development

According to NABARD, the rural sector plays a vital role in India’s overall economy, contributing approximately 18% of the country’s GDP. Despite this, the sector often suffers from inadequate financial support. Vohra urged both government and private sectors to collaborate in creating innovative financial products tailored to the unique needs of rural entrepreneurs.

He mentioned the importance of microfinance institutions in bridging this gap. “Microfinance can empower individuals, especially women, by providing them with the capital they need to start small businesses,” Vohra stated. This approach not only stimulates local economies but also fosters self-sufficiency among rural inhabitants.

Vohra further highlighted that access to credit can lead to improved agricultural practices, better irrigation facilities, and enhanced market access. He believes that investing in these areas will ultimately result in increased productivity and income for farmers.

Importance of Sustainable Financial Solutions

The NABARD Chairman also stressed the importance of sustainable financial solutions that consider environmental impacts. He pointed out that climate change poses significant challenges to rural agriculture. Therefore, financing should not only focus on immediate financial needs but also on long-term sustainability and resilience against climate-related impacts.

By encouraging investments in renewable energy sources, efficient water management, and sustainable farming techniques, NABARD aims to create a framework that supports both economic growth and environmental stewardship.

Vohra acknowledged that while progress has been made, much work remains to be done. He called on the financial sector to innovate and develop products that cater specifically to rural needs. “The time is now for the banking sector to step up and recognize the potential of rural India,” he concluded.

The call to action from NABARD resonates with ongoing efforts to promote inclusive growth and development across the nation. As rural areas continue to face economic challenges, enhancing financial access remains a pivotal step towards building resilient communities.

-

Lifestyle5 months ago

Lifestyle5 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports4 months ago

Sports4 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports5 months ago

Sports5 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle5 months ago

Lifestyle5 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle5 months ago

Lifestyle5 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

Science4 months ago

Science4 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

World4 months ago

World4 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science5 months ago

Science5 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Business5 months ago

Business5 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science5 months ago

Science5 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports5 months ago

Sports5 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science5 months ago

Science5 months agoNew Study Confirms Humans Transported Stonehenge Bluestones