Business

Nvidia Reports Record Profits, Faces Growth Challenges Ahead

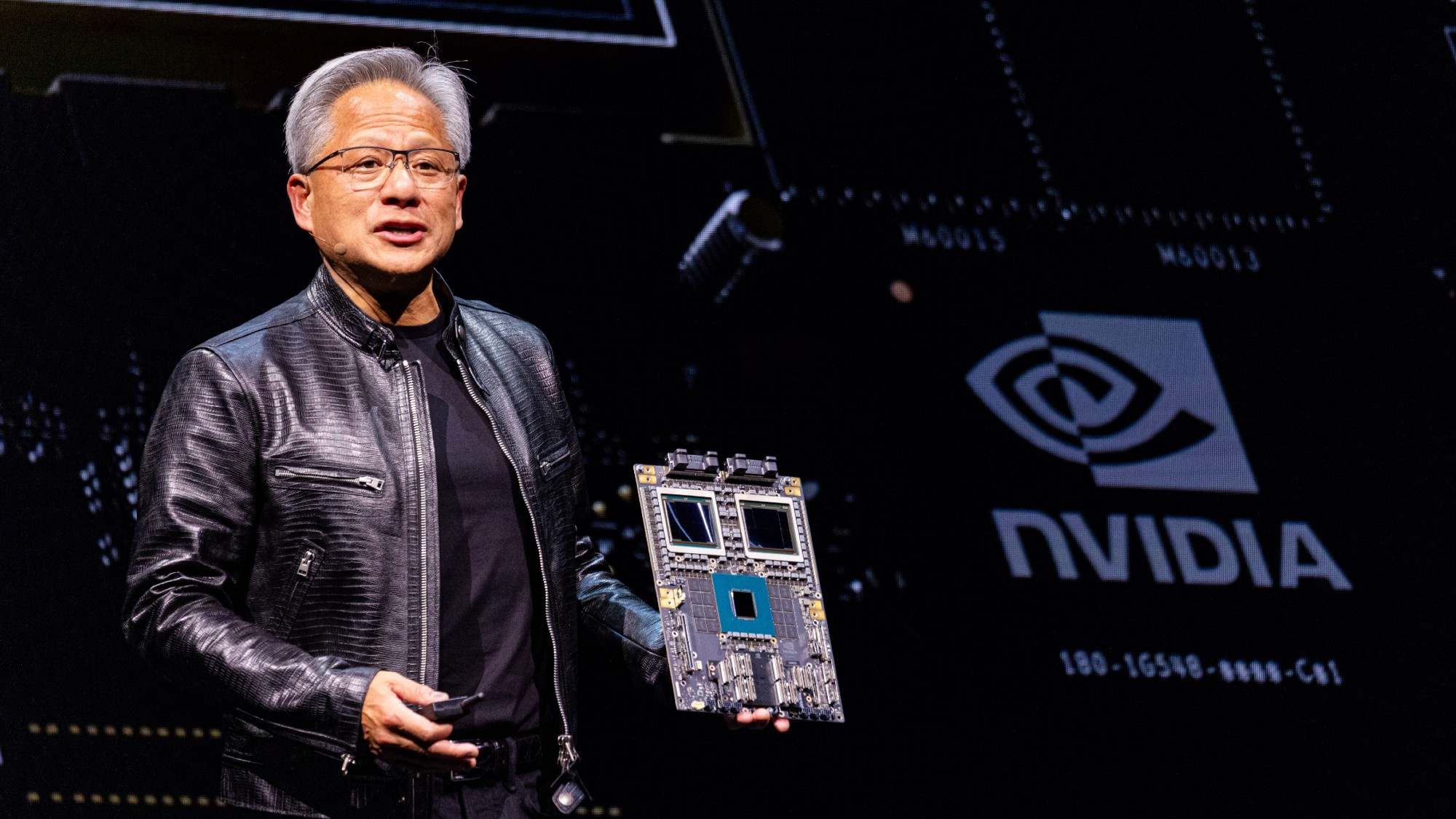

Nvidia has reported another record-breaking quarter, with revenues reaching nearly $47 billion for the most recent period. This marks a 56% increase year-on-year, exceeding market expectations despite ongoing concerns about a potential downturn in the tech sector. CEO Jensen Huang highlighted the company’s strong performance during the earnings call, indicating that Nvidia remains a dominant player in the AI chip market.

While the revenue growth is impressive, it represents Nvidia’s slowest pace in two years. According to Dan Gallagher in The Wall Street Journal, the company has managed to outperform many of its peers in the tech industry, which are currently struggling to maintain growth. This performance comes in the context of restricted sales to China, where exports of Nvidia’s AI chips have been largely curtailed due to national security issues.

China’s market presents a significant challenge for Nvidia. Dewardric L. McNeal from CNBC expressed concerns about the zero revenue from Nvidia’s targeted H20 chip for the Chinese market. The ongoing tensions between the United States and China continue to impede Nvidia’s growth prospects, particularly as competitors like Cambricon Technologies gain traction in the region.

The energy demands of the AI sector also pose a potential hurdle for Nvidia’s expansion. As highlighted by The Economist, the company faces challenges in a landscape where the existing power grid in the United States has not significantly evolved. This reality creates a tension between Nvidia’s rapid growth and the limitations of the infrastructure required to support it.

Despite these headwinds, Nvidia’s valuation remains robust. The company’s current price-to-forward-earnings multiple stands at 33, slightly above tech giants like Microsoft and Oracle, yet its profit growth outpaces them. An analysis by the Financial Times notes that on a PEG ratio basis, Nvidia appears undervalued. However, concerns linger regarding the sustainability of its high valuation, particularly as much of its $4.4 trillion market cap relies on optimistic projections for revenue growth post-2030.

Nvidia boasts a gross margin of 72%, surpassing that of Apple, which raises the possibility of increased competition entering the market. Huang’s vision for Nvidia’s role in shaping the future of AI is compelling, yet it is important to recognize that, at this moment, it remains largely aspirational.

As Nvidia navigates these challenges, the coming quarters will be crucial in determining whether it can maintain its upward trajectory in a rapidly evolving market. The interplay between technological advancements, geopolitical tensions, and energy infrastructure will significantly impact the company’s future performance.

-

Lifestyle3 months ago

Lifestyle3 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports3 months ago

Sports3 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports3 months ago

Sports3 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle3 months ago

Lifestyle3 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle3 months ago

Lifestyle3 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World3 months ago

World3 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science3 months ago

Science3 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Science2 months ago

Science2 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Business3 months ago

Business3 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science3 months ago

Science3 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports3 months ago

Sports3 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science3 months ago

Science3 months agoNew Study Confirms Humans Transported Stonehenge Bluestones