Business

Market Optimism Rises as 2026 Approaches Amid Fed Changes

Investors greeted December with renewed optimism as retail sentiment shifted positively. This uptick aligns with ongoing discussions about the bullish momentum in the market. With equities historically performing well in December, particularly following a year of significant gains, expectations are rising for a potential Federal Reserve rate cut next week. The end of the Fed’s quantitative tightening (QT) on December 1, 2025, has injected fresh liquidity into financial markets, providing a supportive backdrop for year-end rallies.

The Fed’s recent policy pivot has played a crucial role in this optimism. The cessation of balance sheet runoff not only alleviates a persistent headwind but also reignites hopes for a more accommodative monetary stance in 2026. As of now, futures markets indicate a strong likelihood of a 0.25% rate cut at the upcoming Federal Open Market Committee (FOMC) meeting on December 10, 2025. This potential easing, combined with a gradual decline in inflation, has reinforced the “soft landing” narrative that many investors are banking on.

Another factor contributing to the bullish outlook is the notable shift in market dynamics. Investment has increasingly flowed away from previously favored growth stocks toward underperforming sectors like energy, financials, and healthcare. This diversification has helped improve market breadth, a critical component for sustaining a rally. Still, some analysts caution that the current movement appears largely technical and may not fully align with longer-term bullish indicators.

The upcoming week will be pivotal, as market participants closely analyze the Fed’s commentary for insights into the timing and extent of future rate reductions. Additionally, liquidity indicators in short-term funding markets will be vital. If stability persists in these areas, the rally could maintain its momentum. Economic data, particularly on inflation and employment, will further shape expectations, especially following the recent government shutdown.

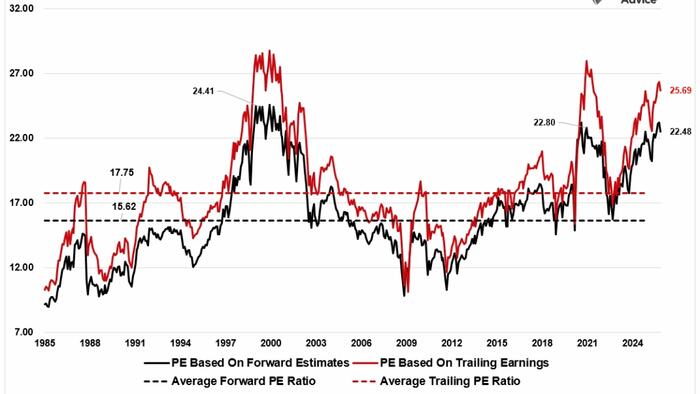

As 2025 draws to a close, investors find themselves at a crossroads, facing two distinct narratives. On one hand, there is a sense of optimism stemming from favorable liquidity conditions and robust capital allocations in key sectors. Conversely, significant unresolved risks linger, including narrow market leadership, elevated valuations, and increasing household financial stress.

These conflicting narratives highlight the ongoing tension between structural market support and underlying economic vulnerabilities. The bullish case is heavily reliant on renewed investments, fiscal support, and a favorable liquidity environment. Should these factors hold, equities may continue to rise, pushing all sectors higher and supporting current valuations.

On the other hand, the bearish perspective warns of potential pitfalls. Key catalysts that fueled the post-pandemic rally are showing signs of fatigue. The concentration of gains among a small group of high-growth companies, particularly those linked to artificial intelligence, raises concerns. Should sentiment around these stocks waver, the broader market could swiftly reverse its gains.

As we look ahead to 2026, it is crucial for investors to remain adaptable. While the present environment suggests a continuation of the bull market, volatility may increase as unresolved issues come to the forefront. The next week is set to be significant, with the Fed meeting acting as a central focus.

Investors should prepare for a range of outcomes. A well-communicated rate cut could stimulate further risk-taking, while any signs of hesitation from the Fed could lead to increased volatility. Labor market data and upcoming earnings from major technology and AI firms will also play a critical role in shaping market sentiment.

In summary, the balance between optimism and caution remains precarious as we transition into 2026. Investors must remain vigilant, ready to navigate both bullish and bearish scenarios. The focus should be on maintaining a disciplined approach, respecting support and resistance levels, and managing risk exposures as market dynamics evolve.

-

Lifestyle5 months ago

Lifestyle5 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports4 months ago

Sports4 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports4 months ago

Sports4 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle4 months ago

Lifestyle4 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle4 months ago

Lifestyle4 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

Science4 months ago

Science4 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

World4 months ago

World4 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science5 months ago

Science5 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Business5 months ago

Business5 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science5 months ago

Science5 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports5 months ago

Sports5 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science5 months ago

Science5 months agoNew Study Confirms Humans Transported Stonehenge Bluestones