Business

India’s Robotics Sector Grows as Local Firms Compete with Giants

India is rapidly evolving into a significant player in the global robotics landscape. According to the International Federation of Robotics, the country installed just over 8,500 industrial robots in March 2023, reflecting a remarkable 59 percent increase from the previous year. Despite this growth, India’s robot density stands at approximately 7 units per 10,000 workers, which is notably lower than that of China at 392 and South Korea at 1,012. With a population of 1.5 billion and an ambitious “Make in India” initiative, the country is poised to become a crucial frontier for robotics.

The landscape is currently dominated by both foreign and domestic players. Leading international manufacturers like ABB, Kuka, and Fanuc have established operations in India, offering proven technology and extensive research and development resources. For instance, Omron recently inaugurated its Automation Center in Bengaluru, which provides essential proof-of-concept facilities, training, and technical support. However, the premium pricing of these foreign systems often limits accessibility for many of India’s small and medium-sized enterprises (SMEs).

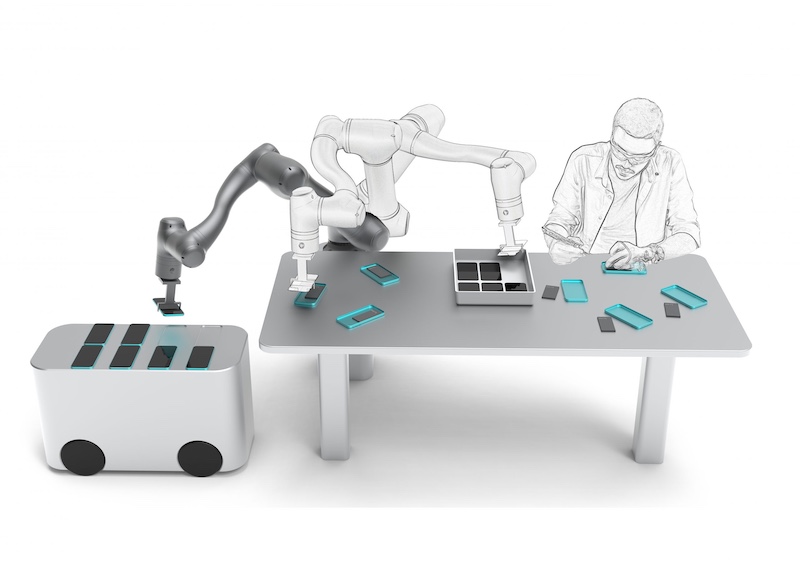

Domestic robotics companies are increasingly stepping in to fill this gap. They focus on developing affordable, rugged systems that cater specifically to the needs of the Indian market. These firms are innovating in areas such as mobile robots, service robots, and industrial arms, ensuring that their solutions align with local manufacturing conditions. For example, companies like GreyOrange and Addverb Technologies are gaining international visibility in warehouse robotics, with Addverb’s collaboration with Reliance Industries providing the necessary capital to scale operations.

Key Players in India’s Robotics Ecosystem

The Indian robotics ecosystem features a diverse range of companies that are not only innovating but also exporting their technologies. Among these, Genrobotics has made a significant impact with its sewer-cleaning machines, which replace hazardous manual scavenging. Meanwhile, Sastra Robotics and Planys Technologies are demonstrating the potential for Indian startups to develop advanced systems for specialized tasks, including electronics testing and underwater asset inspection.

India’s drone industry is also thriving, with firms like IdeaForge and Garuda Aerospace attracting interest from both the defence sector and commercial markets. This diversity is critical; India’s fragmented industrial base, which includes millions of SMEs, requires tailored automation solutions rather than one-size-fits-all approaches typically favored by larger manufacturers.

A significant aspect of India’s automotive sector, which includes well-known names like Tata, Mahindra, and Bajaj Auto, is the uneven adoption of automation. While global demand for uniformity and precision in manufacturing is rising, Indian automakers often cater to local markets with products that allow for higher variability in production. Embracing robotics more aggressively could transition these manufacturers from regional players to global exporters.

The Future of Robotics: A Dual Path Ahead

Cultural perceptions of manufacturing in India still lean towards “organic” design, which celebrates hand-finished goods and artisanal variations. This approach, while valued locally, may hinder competitiveness in global markets that prioritize consistency and precision. The challenge lies in determining whether India will maintain its artisanal identity or fully embrace industrial automation.

The economics of automation are changing. Collaborative robots currently range in price from $20,000 to $40,000, while the cost of employing a factory worker over five years can reach $15,000. As robots become more affordable and wages increase, SMEs may start recognizing the long-term benefits of automation, making it a rational choice for their operations.

The competition between foreign original equipment manufacturers (OEMs) and domestic robotics builders will significantly shape the future of the sector. While foreign companies provide reliable technology and global networks, local firms can leverage their understanding of the Indian market to deliver customized solutions. The success of companies like GreyOrange exemplifies how Indian firms can achieve global recognition in robotics.

As the next decade unfolds, India stands at a crossroads. It has the potential to emerge as a major exporter of robotic systems rather than simply a consumer market for imported technologies. The outcome will depend on whether domestic firms can thrive alongside foreign competitors, ultimately defining India’s role in the global robotics industry. The stakes are high, and the decisions made today will influence the country’s manufacturing landscape for years to come.

-

Lifestyle3 months ago

Lifestyle3 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports3 months ago

Sports3 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports3 months ago

Sports3 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle3 months ago

Lifestyle3 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle3 months ago

Lifestyle3 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World2 months ago

World2 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science3 months ago

Science3 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Business3 months ago

Business3 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science3 months ago

Science3 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Science2 months ago

Science2 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Sports3 months ago

Sports3 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science3 months ago

Science3 months agoNew Study Confirms Humans Transported Stonehenge Bluestones