Business

Understanding EBITDA: Insights from Industry Experts

A recent analysis by Greg Feirman highlights significant concerns regarding the use of adjusted EBITDA as a reliable measure of corporate performance. EBITDA, which stands for “Earnings Before Interest, Taxes, Depreciation, and Amortization,” has gained popularity as a straightforward metric for assessing a company’s profitability. However, its simplicity raises questions about accuracy, particularly in capital-intensive industries.

EBITDA often overlooks critical costs, such as depreciation, thereby distorting a firm’s financial health. For instance, companies extending the lifespan of assets may present inflated EBITDA figures, masking underlying cash outflows. As Feirman pointed out, this issue becomes particularly pronounced in the aftermath of economic downturns when capital expenditures typically rise.

Investment in the artificial intelligence sector has seen substantial growth, with firms allocating billions to infrastructure like chips and data centers. This trend correlates with economic recovery phases, as companies ramp up production to meet increasing demand.

On social media, investor Michael Burry emphasized concerns about the AI sector’s financial practices. He argued that companies in this field, including CoreWeave, are underreporting depreciation by extending the useful life of assets. CoreWeave’s recent earnings report illustrates this point: the company announced an adjusted EBITDA of $838 million, a significant jump from $379 million a year prior. However, this figure was achieved by excluding $630 million in depreciation from their $110 million GAAP net loss.

The true financial picture is revealed when examining CoreWeave’s cash flow statement. In the first nine months of 2025, the company reported $1.5 billion in cash flow from operations, yet its capital expenditures reached $6.25 billion, resulting in a negative free cash flow of $4.75 billion. To finance this deficit, CoreWeave has relied on debt, with net debt issuance amounting to approximately $4.5 billion.

This situation underscores a critical disconnect: while EBITDA may suggest operating profitability, cash flow dynamics depict a different narrative. Relying solely on EBITDA can obscure the reality of cash burn, excessive borrowing, or unrealistic asset life assumptions.

Feirman cautioned that investors should be aware of several pitfalls associated with EBITDA. It fails to account for capital expenditures and replacement needs, omits changes in working capital that can impact cash flow, and masks debt burdens. Furthermore, the subjective nature of “adjusted” EBITDA can diminish comparability across companies and time periods.

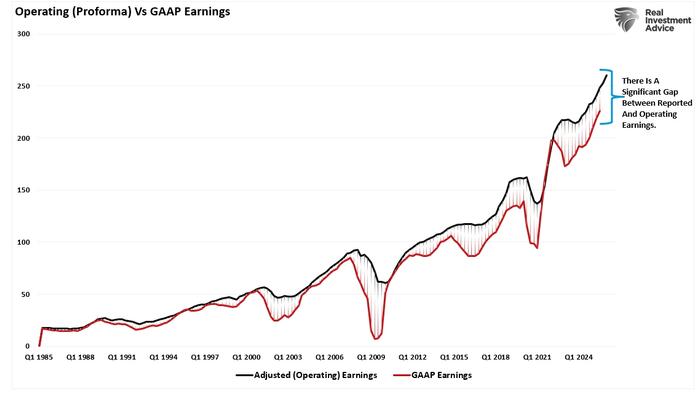

The manipulation of earnings has become prevalent, with many investors making decisions based on distorted financial figures. Drew Bernstein, writing for CFO.com, pointed out that non-GAAP financials, which are often unverified, have proliferated in earnings reports. These figures are frequently devoid of the rigor applied to GAAP earnings and can mislead investors about a company’s true financial state.

Historically, companies reported GAAP earnings prominently, while adjusted earnings were often mentioned in the fine print. Today, the trend has reversed, with adjusted metrics taking center stage. This shift can lead to an inflated perception of a company’s profitability. According to analysts at Bank of America Merrill Lynch, the rise in companies reporting adjusted earnings correlates with declining earnings power, highlighting a troubling trend for investors.

Charlie Munger, the renowned investor, has been vocal about the shortcomings of EBITDA, labeling it as “bulls*** earnings.” He criticized the tendency to manipulate financial reporting to achieve favorable outcomes, emphasizing that this practice can mislead stakeholders regarding a company’s true financial performance.

Investors are advised to focus on metrics that accurately reflect cash generation and sustainable operations. Key indicators include free cash flow, which is calculated by subtracting capital expenditures from operating cash flow. A positive free cash flow indicates that a company is generating more cash than it needs for maintenance and growth. Conversely, negative free cash flow signals dependence on debt for survival.

Additionally, examining trends in working capital and realistic depreciation policies is essential for understanding a company’s financial health. Investors should scrutinize the relationship between EBITDA and fundamental cash flow figures, particularly in capital-intensive sectors like AI, where the potential for misrepresentation is heightened.

In summary, the reliance on EBITDA and other adjusted earnings metrics can lead investors astray. A more comprehensive approach, emphasizing cash flow and realistic financial practices, is necessary for making informed investment decisions. As the landscape of financial reporting evolves, understanding the nuances of these metrics will be crucial for navigating the complexities of corporate performance.

-

Lifestyle4 months ago

Lifestyle4 months agoLibraries Challenge Rising E-Book Costs Amid Growing Demand

-

Sports4 months ago

Sports4 months agoTyreek Hill Responds to Tua Tagovailoa’s Comments on Team Dynamics

-

Sports4 months ago

Sports4 months agoLiverpool Secures Agreement to Sign Young Striker Will Wright

-

Lifestyle4 months ago

Lifestyle4 months agoSave Your Split Tomatoes: Expert Tips for Gardeners

-

Lifestyle4 months ago

Lifestyle4 months agoPrincess Beatrice’s Daughter Athena Joins Siblings at London Parade

-

World4 months ago

World4 months agoWinter Storms Lash New South Wales with Snow, Flood Risks

-

Science4 months ago

Science4 months agoTrump Administration Moves to Repeal Key Climate Regulation

-

Science3 months ago

Science3 months agoSan Francisco Hosts Unique Contest to Identify “Performative Males”

-

Business4 months ago

Business4 months agoSoFi Technologies Shares Slip 2% Following Insider Stock Sale

-

Science4 months ago

Science4 months agoNew Tool Reveals Link Between Horse Coat Condition and Parasites

-

Sports4 months ago

Sports4 months agoElon Musk Sculpture Travels From Utah to Yosemite National Park

-

Science4 months ago

Science4 months agoNew Study Confirms Humans Transported Stonehenge Bluestones